Why Bitcoin Has Surpassed $100K: An In-Depth Analysis

Over the past few years, Bitcoin has undergone significant growth, reaching milestones that seemed almost unimaginable in the early days of cryptocurrency. Recently, Bitcoin crossed the $100K mark, making headlines across financial markets worldwide.

But what exactly has caused Bitcoin’s price to surge to such an astronomical figure? In this article, we will explore the factors behind Bitcoin’s remarkable rise and explain why this digital asset has become a mainstay in the global economy.

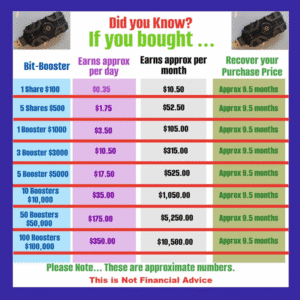

Do You Want To Earn More Bitcoin Daily And Become Your Own Bank? $$$ EARN BITCOIN PASSIVELY THE NUMBER ONE COIN!

1. Increased Institutional Bitcoin Adoption

One of the most significant drivers behind Bitcoin’s rise to over $100K is the increased institutional Bitcoin adoption. Over the past few years, Bitcoin has transitioned from being considered a speculative asset to being recognized as a legitimate store of value.

Major institutional investors, including hedge funds, asset managers, and publicly traded companies, have started allocating a portion of their portfolios to Bitcoin. Companies like MicroStrategy, Tesla, and Galaxy Digital have made Bitcoin a part of their financial strategies, signaling that Bitcoin is not just for retail investors anymore.

Institutional interest in Bitcoin has brought with it more liquidity and stability, which has attracted additional capital. This influx of institutional money has helped boost Bitcoin’s price to new heights.

2. Growing Global Inflation Hedge

As global inflation continues to rise, many investors are turning to alternative assets like Bitcoin to hedge against inflation. With central banks printing money at unprecedented rates, the fear of inflation has increased, leading many to seek out assets that could retain value over time. Bitcoin, often referred to as “digital gold,” has become a popular choice for investors looking to protect their wealth from inflation.

Bitcoin’s limited supply of 21 million coins makes it an attractive alternative to traditional fiat currencies, which can be printed endlessly. As inflation fears grow, more people are seeing Bitcoin as a store of value rather than just a speculative investment.

3. Bitcoin Payment Systems Gain Traction

Another contributing factor to Bitcoin’s price surge is the growing acceptance of Bitcoin as a payment method by large companies. In recent years, businesses across various industries have started accepting Bitcoin as a form of payment. Companies such as PayPal, Square, and Visa now allow users to transact with Bitcoin, expanding the cryptocurrency’s use case and demonstrating its increasing mainstream adoption.

The integration of Bitcoin into payment systems has not only helped to legitimize the cryptocurrency but has also made it more accessible to everyday users. This accessibility drives more demand, which, in turn, pushes the price higher.

4. Blockchain Technology Innovations

Bitcoin’s underlying technology, blockchain, continues to evolve, making the network more secure, scalable, and efficient. Improvements such as the Lightning Network allow for faster and cheaper transactions, which has made Bitcoin more practical for everyday use. Additionally, innovations like taproot, which enhances Bitcoin’s privacy and smart contract capabilities, have strengthened its utility and appeal to both investors and developers.

These blockchain technology advancements have helped ensure Bitcoin’s long-term viability, encouraging more people to buy and hold the cryptocurrency, thus driving up its value.

5. The Bitcoin Halving Cycle and Limited Supply

The periodic Bitcoin “halving” events, which occur approximately every four years, play a significant role in Bitcoin’s price appreciation. During a halving event, the reward for mining Bitcoin is cut in half, reducing the rate at which new bitcoins are created. As a result, the supply of new Bitcoin decreases, leading to a reduction in inflationary pressure and making Bitcoin more scarce.

Historically, each Bitcoin halving cycle has been followed by a significant increase in price. With the next halving event expected in 2024, many analysts predict that Bitcoin’s price could rise even further, potentially pushing it beyond the $100K mark.

6. DeFi Platforms Drive Demand for Bitcoin

The growth of DeFi platforms (Decentralized Finance) has also played a pivotal role in Bitcoin’s price surge. DeFi applications, which are built on blockchain technology, enable users to borrow, lend, and trade digital assets without relying on traditional financial intermediaries. Bitcoin is often used as collateral in these DeFi platforms, increasing its demand.

As DeFi continues to grow, Bitcoin’s role as the foundation for decentralized financial services is likely to become more pronounced, further contributing to its price appreciation.

7. Bitcoin Regulatory Clarity and Legal Recognition

Another important factor in Bitcoin’s rise to over $100K is the increasing regulatory clarity around cryptocurrency. Governments and regulatory bodies around the world are slowly developing frameworks for the use and taxation of Bitcoin and other cryptocurrencies. The United States, for example, has introduced clearer guidelines regarding the taxation of crypto assets, while countries like El Salvador have recognized Bitcoin as legal tender.

This regulatory clarity has reassured investors, both institutional and retail, that Bitcoin is a legitimate and secure asset to hold, helping to drive demand and push its price higher.

8. Decentralized Financial Services Are Expanding

The rise of decentralized financial services (DeFi) has provided additional use cases for Bitcoin. As more individuals and institutions engage in decentralized finance, the demand for Bitcoin as collateral or a trading asset has skyrocketed. DeFi allows Bitcoin to be utilized in lending, borrowing, and earning interest without needing centralized financial institutions, increasing its utility and appeal.

As the DeFi sector expands, the value of Bitcoin continues to climb, as the digital asset plays an integral role in the future of finance.

9. Bitcoin ETFs Make It Easier for Investors to Buy

The launch of Bitcoin exchange-traded funds (ETFs) has been another key factor in Bitcoin’s price increase. Bitcoin ETFs make it easier for institutional and retail investors to gain exposure to Bitcoin without needing to buy and store the digital asset directly. The approval of Bitcoin ETFs in countries like Canada and the United States has helped broaden Bitcoin’s appeal to a wider range of investors.

These ETFs have provided more liquidity and have made it easier for large institutions to invest in Bitcoin, contributing to the asset’s rise in value.

10. Bitcoin as a Store of Value

Bitcoin’s reputation as a store of value has continued to grow, particularly during times of economic uncertainty. In a world where traditional markets and fiat currencies are subject to volatility, Bitcoin has gained traction as a stable asset class. Its ability to function as a hedge against global instability, much like precious metals such as gold, has drawn many to view it as a safer alternative to holding cash or stocks.

As more investors look for reliable stores of value, Bitcoin’s role as a store of value continues to grow, propelling its price upward.

11. The Rise of Wealth Management Bitcoin Strategies

Wealth management Bitcoin strategies have become more prominent as high-net-worth individuals seek to diversify their portfolios. As Bitcoin becomes a key part of wealth preservation strategies, many investment firms have incorporated the cryptocurrency into their offerings. This trend is pushing Bitcoin into the mainstream investment world and is likely a significant factor in its continued price appreciation.

Wealth management firms that incorporate Bitcoin into their clients’ portfolios have contributed to the cryptocurrency’s status as a legitimate investment class, further increasing demand for Bitcoin.

12. Bitcoin’s Global Appeal Expands

Unlike traditional fiat currencies, which are subject to the policies of individual governments, Bitcoin operates globally. Its decentralized nature means that it is not bound by any one country’s economic policies. This global appeal has attracted investors from around the world who view Bitcoin as a universal store of value that transcends national borders.

As more countries recognize Bitcoin’s potential and as global adoption increases, Bitcoin’s value will likely continue to rise.

Conclusion

The journey of Bitcoin to over $100K is a testament to its growing recognition as a legitimate and valuable asset. Factors like increased institutional Bitcoin adoption, concerns over inflation, blockchain technology innovations, regulatory clarity, and the growth of DeFi platforms have all contributed to Bitcoin’s rise in value. As global awareness of Bitcoin continues to spread, we are likely to see even more significant milestones in the future.

For investors, understanding these driving forces is crucial in navigating the evolving landscape of cryptocurrency. While Bitcoin’s future remains uncertain, its continued rise above $100K demonstrates its resilience and the growing trust in its long-term potential.

Do You Want To Earn More Bitcoin Daily And Become Your Own Bank? $$$ EARN BITCOIN PASSIVELY THE NUMBER ONE COIN!